SBS Financial Planner

The MAT Standard. For Finance Leaders who expect more.

Join our next webinar: Raising the MAT Standard

A trust perspective on budgeting pressures and how SBS Financial Planner has been rebuilt in response to these realities.

Every MAT Finance Leader knows the Challenge

Budgets move. Targets Change. Priorities Shift. The pressure to get it right never stops.

Education finance is moving fast. As core costs rise and pupil numbers fall, your financial decisions matter more than ever.

That’s why SBS Financial Planner is developed alongside MAT CFOs – delivering clarity, confidence, and control in every decision.

Meet The MAT Standard

SBS Financial Planner is designed specifically for MATs and helps restore clarity where complexity has taken over. So you can plan, forecast and lead your MAT with confidence.

Truly MAT-Led Budgeting

SBS Financial Planner supports the scale and complexity of MATs, allowing assumptions to be set centrally, model trust wide scenarios, and ensure consistency across all schools.

Smarter Financial Decisions

With real-time insights and forecasting, MAT leaders can plan ahead with confidence, identify potential efficiencies, and ensure financial sustainability.

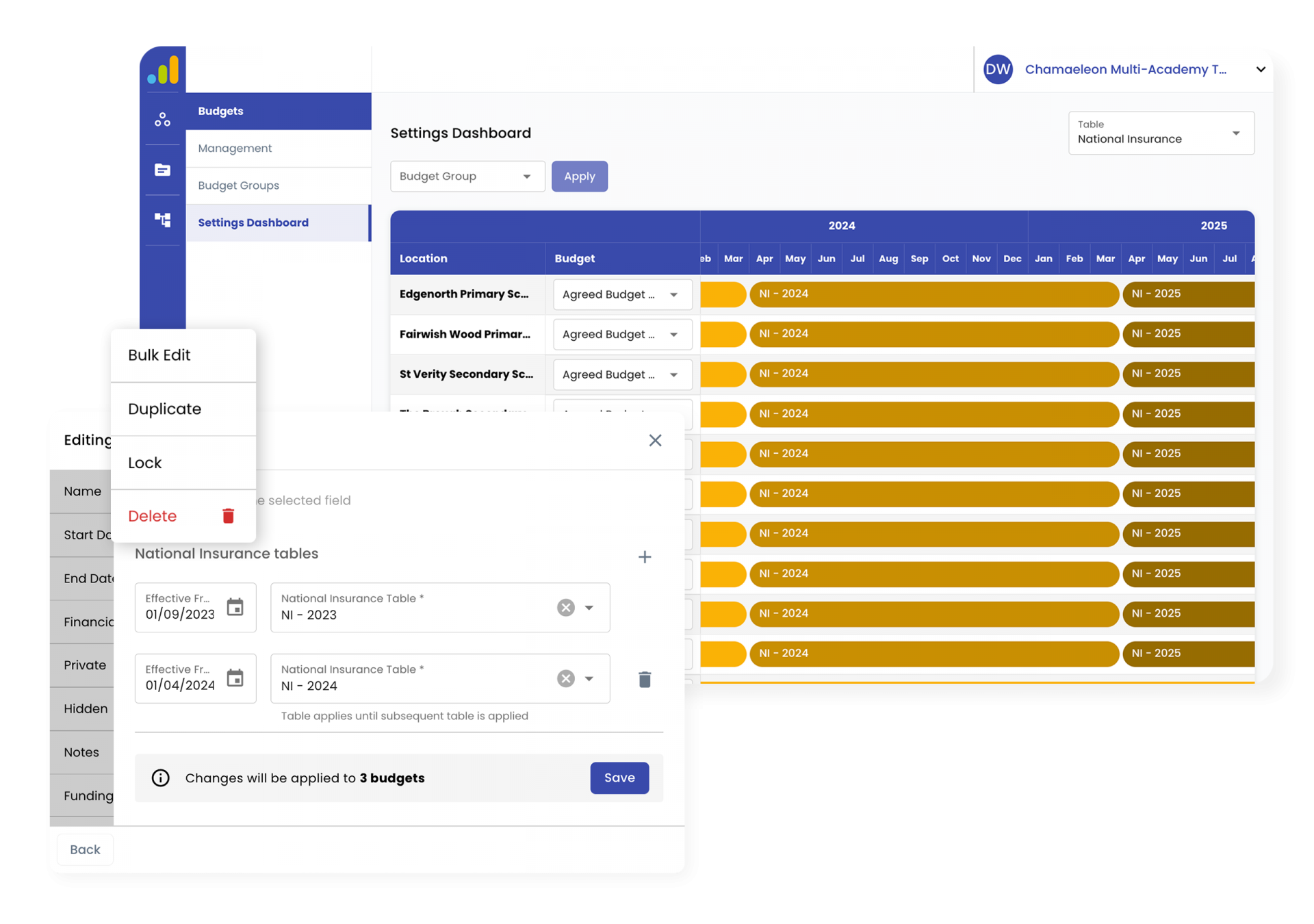

Powerful Integrations & Real-Time Modelling

Seamlessly syncs with several finance systems. Updated tables are available for NI rates, pay scales, Extended Leave Rates and LA Funding. Model GAG pooling, top-slice, and school-level budgets with confidence.

Ensured Compliance & Audit Readiness

SBS Financial Planner keeps MATs and schools fully compliant with DfE and statutory reporting requirements.

Here's What Our Users Say...

56%

Easier scenario planning

49%

Reduced time spent on data input or reconciliation

37%

Have improved visibility across the Trust

50%

Save at least one hour every week on budgeting tasks with 10% saving a full working day a week

“SBS FP is perfect for growing Trusts. It’s scalable, easy to use, and offers the kind of insights you need to lead effectively. It’s not just a product – it’s a strategic solution.” - Philip Norman, CFOO, Drapers' Multi-Academy Trust

Powerful Features, Better Financial Decisions

The right tools to manage budgets, forecast with confidence, and stay in control of your Trust’s finances

Centrally Manage Budgets & Assumptions

Take complete control of Trust-wide financial planning with a fully centralised, MAT-designed approach. Set core assumptions, from pay scales and on-costs to funding rates, and group schools by phase, region or funding model to reflect the structure of your Trust.

This creates consistency, accuracy and total financial oversight across every school. And with Trusts reporting up to a 30% reduction in budgeting workload, centralised planning delivers clarity and efficiency where it matters most.

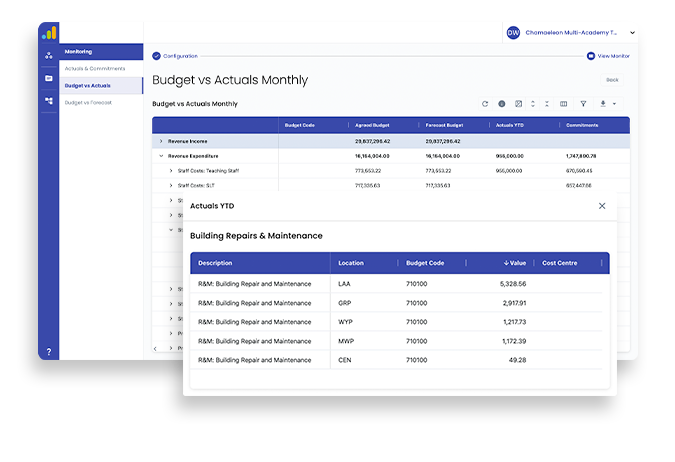

Transactional Drill-Down in Reports & Monitoring

Move from Trust-wide financial summaries to transaction-level detail in a single click. Drill down directly within your reports, no switching systems, no wasted time.

This level of visibility helps you pinpoint trends, prevent overspend, and strengthen financial accountability across every school. Trusts using SBS Financial Planner report significantly faster month-end reviews, with clearer insights and fewer manual checks.

Book a demo

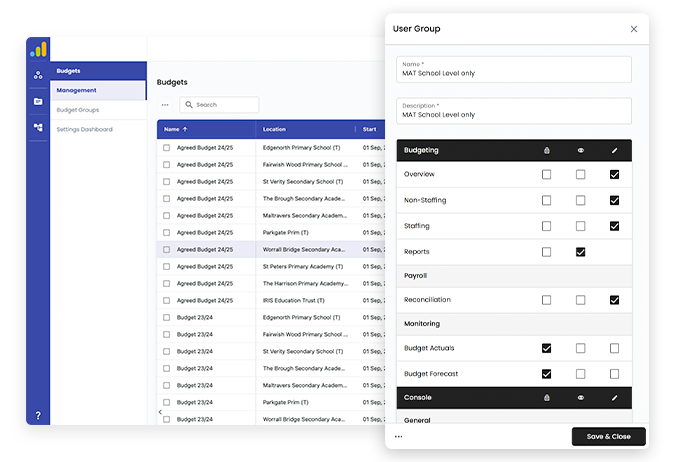

Unlimited Scenarios & Role-Based User Access

Plan with confidence using unlimited scenarios to test funding changes, staffing options, and cost pressures — all without duplicating work. Use private or hidden views for leadership discussions before plans are finalised.

With unlimited users and precise role-based permissions, you control who sees what, enabling secure collaboration across your Trust. 56% of Trusts report easier scenario planning when using SBS Financial Planner, giving leadership faster insights and more confident decision-making.

Comprehensive Support & Fully Managed Onboarding

From the moment you switch, our team is here to make your transition seamless. SBS Financial Planner includes fully managed onboarding, unlimited training, and dedicated support through live chat, helpdesk, and step-by-step video guides.

Whether it’s setup, scenario planning, or day-to-day queries, our experts ensure you get the most from your budgeting software. Trusts report a 8-week implementation, with full support at every stage, so teams are productive and confident from day one.

SBS Financial Planner

is trusted by:

250+

Multi-academy Trusts

2,000+

Schools

Why Finance Teams Choose SBS Financial Planner

Attenborough Learning Trust

“I’d absolutely recommend the system to other trusts. It is good value and with the link to Iris Financials we have a clear picture at the beginning and throughout the financial year which underpins our budget processing." - Tom Bott, Finance Manager

Drapers' Multi-Academy Trust

“It’s so much more intuitive and helps us to be more efficient – we can drill into data, run insightful reports, and it saves a lot of time. The planner’s accuracy and automation give us the confidence we need to make financial decisions.” - Philip Norman, CFOO

Farmor's School

“Quicker, less clunky and easy to navigate website is a less stressful experience and better for my wellbeing!” - Sarah Grieg, School Business Manager

St Clement's Catholic Primary School

“SBS Financial Planner is a more user friendly system that the previous system I used and it is visually and physically a better system to use.” - Laura Adams, School Business Manager

Book a call with the team today to explore the new software.

Book a demo

Download our FREE guide to Financial Modelling in SBS Financial Planner

8 ways to help streamline your budgeting setting and decision making.

Find out how SBS Financial Planner can help you create unlimited scenarios and compare them to your budget to optimising your spending.

Download Free Guide

Book a Free Demo of SBS Financial Planner Today

SBS can take care of your day-to-day operations as well as manage your school budget using SBS Financial Planner.

- Centralise and simplify your financial processes

- Real-time forecasting, tracking and budgeting

- Built-in compliance and supports GAG pooling

Get in touch

See some of our Frequently Asked Questions

SBS Financial Planner is a complete budgeting and forecasting tool designed for schools, MATs, and local authorities. Key features include centralisation of chart of accounts and budget assumptions such as pay scales and inflation, pupil number forecasting, integrated staffing and payroll planning, multi-year budget modelling, scenario planning, consolidated Trust-wide reporting, and automated DfE-compliant reports. It’s built to simplify complex finance processes and support better strategic decision-making.

Book a no obligation demo to see all of our features in action

Regardless of whether you are a single school, MAT or LA, SBS Financial Planner is accessed via a single login and database.

It gives you total control over a single chart of accounts, centralised assumptions including pay scales, inflation and ERs pension, and other budget factors. Flexibility is also built in to cope with subtle differences between schools such as 1FTEs and pay scales, and to allow users to create different budget models and scenarios for one school or across the whole organisation.

Yes. SBS Financial Planner integrates seamlessly with popular finance systems, including Xero for Education, Sage Intacct, IRIS Financials and Iplicit. This allows you to automatically sync actuals and commitments, reducing manual data entry, improving accuracy, and keeping your budgets and reports up to date in real time. You can also transfer an agreed and forecast budget back into your finance system.

Unlike generic budgeting software, SBS Financial Planner is built with schools and MATs in mind. It was shaped with input from Trust CFOs, making it a true MAT-led solution.

It goes beyond basic spreadsheets by combining pupil forecasting, staffing, and financial planning into one platform, delivering DfE-compliant outputs and supporting both operational and strategic finance needs.

Yes. SBS Financial Planner supports multi-user access, making it easy for CFOs, SBMs, and finance teams to collaborate. Permissions can be customised so different users can view, edit, or report on specific areas of the budget without compromising data security or accuracy.

Most schools and MATs can be fully set up in just eight weeks. Our team handles the onboarding process, including data migration, customisation, and training, so you can start planning and reporting quickly without disrupting your finance workflows.

Yes. Every new SBS Financial Planner customer receives full onboarding support. This includes guided setup, personalised training for your team, and access to ongoing help from our UK-based support team. We also provide regular updates and webinars to help you make the most of new features.

Security is a top priority. SBS Financial Planner is hosted in secure UK-based data centres, is GDPR compliant, and uses industry-standard encryption of data, both in transit and at rest. Regular audits and backups ensure your financial information is safe and always available when you need it. An additional layer of security can be added to users via 2-factor authentication.

Yes. You can assign custom permissions for different roles within your organisation. For example, CFOs can have full access, while SBMs or school leaders can have restricted access to specific reports or areas of the budget, ensuring both collaboration and data security. You can also determine which users have access to specific schools within your organisation.

SBS Financial Planner produces DfE-compliant reports as well as custom dashboards and summaries for Trustees, Governors, and leadership teams. From consolidated Trust-wide overviews to detailed school-level analysis, the reporting tools make it easy to share accurate, timely data with stakeholders.

For MAT CFOs, SBS Financial Planner simplifies the challenge of managing multiple school budgets. It consolidates financial data across your Trust, giving you a clear, real-time view of performance, commitments, and forecasts. This makes it easier to plan strategically, report accurately, and make informed decisions for the Trust as a whole.